Faith in the Future

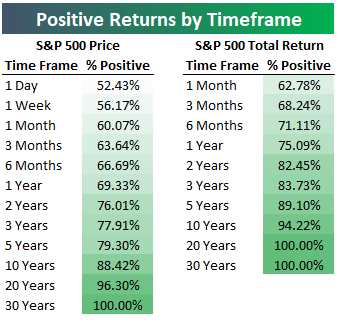

This month’s commentary centres around the right perspective for a successful investor: faith. On a definitional level, faith is trust in a person, thing, or concept. So, when we say, “faith in the future”, we are referring to a general state of optimism about the passage of time and how that positively impacts our wealth. Of course, this statement does not presuppose that all future events are inherently uplifting—some will be quite damaging and painful—it simply aligns us with a very strong reality that, in aggregate, the financial prosperity of human beings is growing. Boiled down to its essence, we see the future as an opportunity to increase our wealth. For those of you who need convincing, we have borrowed some market statistics from Bespoke Investment Group to prove our point. Pictured below are the timeframes of the S&P 500 (price and total return) dating back to 1928 and the percentage these periods are positive.

Source: Bespoke

Our observations:

- On any given day you are a little better than 50/50 to make money.

- As your timeframe increases (i.e., faith in the future), so does the probability of a positive return.

- Total return investors (dividends reinvested) have both higher returns and higher probabilities.

- Time periods greater than 10 years average greater than 90% to produce positive returns.

- All 16-year time periods for the S&P 500 total return since 1928 (not pictured in the above chart) have generated positive returns 100% of the time.

Of course, there is no guarantee that these statistics will repeat in the future, but the math is certainly compelling and supportive of long-term investing. We place our faith in a future where businesses will continue to produce goods and services that we need, want, and desire. Our ownership of these businesses, through prudent long-term investing, secures our prosperity.

Information in this article is from sources believed to be reliable, however, we cannot represent that it is accurate or complete. It is provided as a general source of information and should not be considered personal investment advice or solicitation to buy or sell securities. The views are those of the author, Patrick A. Choquette, and not necessarily those of Raymond James Ltd. Investors considering any investment should consult with their Investment Advisor to ensure that it is suitable for the investor’s circumstances and risk tolerance before making any investment decision. Raymond James Ltd. is a Member - Canadian Investor Protection Fund.