Common Sense Investing

“An investment operation is one which, upon thorough analysis, promises safety of principal and an adequate return. Operations not meeting these requirements are speculative.”

--Benjamin Graham, The Intelligent Investor

In a world of financial confusion and analysis paralysis, I thought it would be constructive to get back to the basics of investing and illustrate the framework for making good investment decisions. We will use the above quote by Benjamin Graham to unpack the necessary steps for investing. For those of you who are unfamiliar with his name, Benjamin Graham is considered the father of formal security analysis and a former professor of Warren Buffett. He is considered the pioneer of “value investing”. Here we go!

- Thorough analysis: You simply must know what it is you are investing in. Too many times investors lack knowledge of the companies they own, the businesses these companies compete against, their level of profitability, and the prospects for the industry as a whole. Financial statements, company filings, and factual news briefs provide vital information in investment analysis. There is no short-cut for doing your homework and exercising care in your analysis. Computers can help scrub data and make complex calculations, but they should not replace your common sense. Always be skeptical of data that is too good to be true!

- Promises safety of principal: This is a very important concept for investors to understand. Ben Graham coined the phrase “margin-of-safety”. What he meant by this concept is quite simple: Do not overpay for an investment. The thorough analysis of company specific financial data can give you insights into the quality of any investment opportunity. Here is an example dating back to the great tech-wreck of 2000 which illustrates the point:

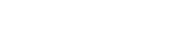

What you are witnessing here is the three-year demise of microchip maker Qualcomm. It was a major supplier of semiconductors to the telecommunication industry back in the late 1990s. At the end of 1999, it was a $124 billion US company and by the end of 2002 it shrunk to a $29 billion US company. Why? Well you overpaid for the stock. I remember the euphoria of 1999. On December 31 of that year, you would have paid over 400x trailing earnings for the stock earning roughly 20 cents a share. It doesn’t take a genius to see that this proposition wasn’t sound. The stock price collapsed over 79% by the end of 2002. In case you hadn’t guessed there was no margin of safety. So how about the old adage of buy-and-hold and the price will recover. Well, pictured below is the total return of Qualcomm for the past 10 years ending on December 31, 2019. As you can see the price hasn’t changed in 10 years. The only return came about by dividends which were introduced back in 2003.

Source: Factset

So, in essence, by disregarding the price paid you took on the risk of eroding your safety of principal. Future earnings growth would have to be astronomical to justify the lofty share price you paid back in 1999 or the price needed to drop as expectations were not met. As history shows, the latter happened. This is just one example using a valuation metric like P/E to illustrate the concept of overpaying. Many other examples exist and will continue to exist as investors speculate instead of operate.

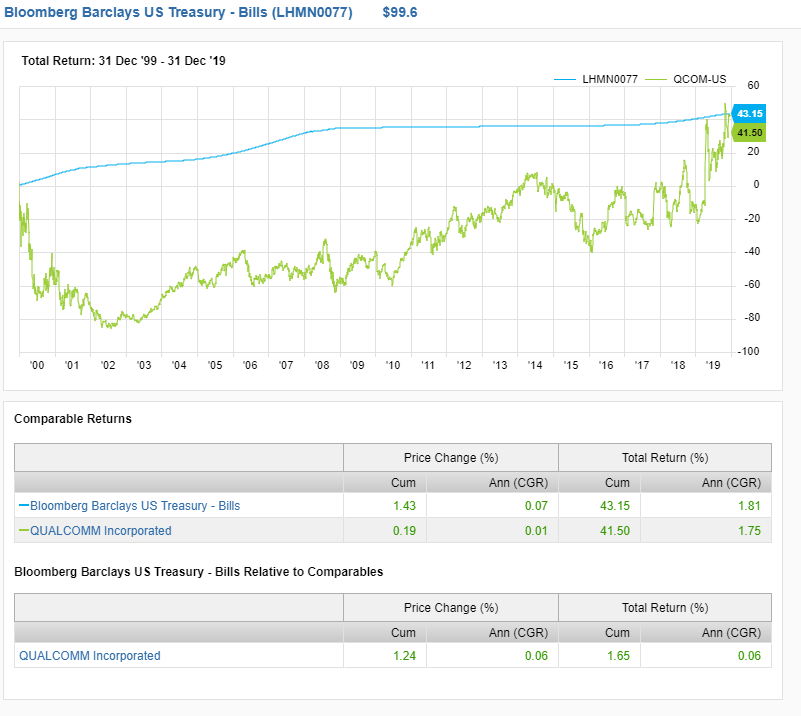

- Adequate return: You need to be compensated for the risk taken in an investment. The more you pay for an asset, all things considered, the less your potential return when you sell it. In the case of QCOM above, you made 1.75% for 10 years. Coincidently, an investment in US T-bills would have produced the same total return as seen below. The big difference here is that US T-bills are considered risk-free investments. Clearly, QCOM did not create an adequate return.

Source: Factset

Our discussion today was to prompt you to ask further questions when someone tries to convince you of an outstanding investment opportunity. In order for it to be a sound investment it should be thoroughly analyzed, be bought at a discount, and offer an adequate return. If it does not live up to these three principles it should not be purchased. For those of you who hire money managers, like mutual funds, or portfolio management services, like me, this checklist needs to be an integral part of investment process or the else you are opening the door to speculation.

The enclosed article expresses the opinions of writer, Patrick A. Choquette, and not necessarily those of Raymond James Ltd. (“RJL”). Statistics, factual data and other information are from sources believed to be reliable but accuracy cannot be guaranteed. It is furnished on the basis and understanding that Raymond James Ltd. is to be under no liability whatsoever in respect thereof. It is for information purposes only and is not to be construed as an offer or solicitation for the sale or purchase of securities.

Information provided in the attached report is general in nature and should NOT be construed as providing legal, accounting and/or tax advice. Should you have any specific questions and/or issues in these areas, please consult your legal, tax and/or accounting advisor.

Information in this article is from sources believed to be reliable, however, we cannot represent that it is accurate or complete. It is provided as a general source of information and should not be considered personal investment advice or solicitation to buy or sell securities. The views are those of the author, Patrick Choquette, and not necessarily those of Raymond James Ltd. Investors considering any investment should consult with their Investment Advisor to ensure that it is suitable for the investor’s circumstances and risk tolerance before making any investment decision. Raymond James Ltd. is a Member - Canadian Investor Protection Fund.