Diversification…Your only free lunch!

I thought that I would send out a comforting note about the power of diversification to preserve and protect your portfolio in times of duress. Once again, we are faced with the prospects of a bear market and many are confused as to which way to turn. Here’s some practical advice to position for long-term gains.

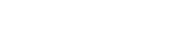

- Invest in more than one asset class. I know many of you have heard me say this in the past, and I will say it again: Don’t just buy stocks, bonds, or keep cash. Combine them together for better risk-adjusted returns. In the example below, you can see that not all assets classes react in the same fashion. Since the beginning of the year, the USD, Canadian bonds, Canadian cash, and Canadian real estate trusts have softened the blow from the sell off in equities.

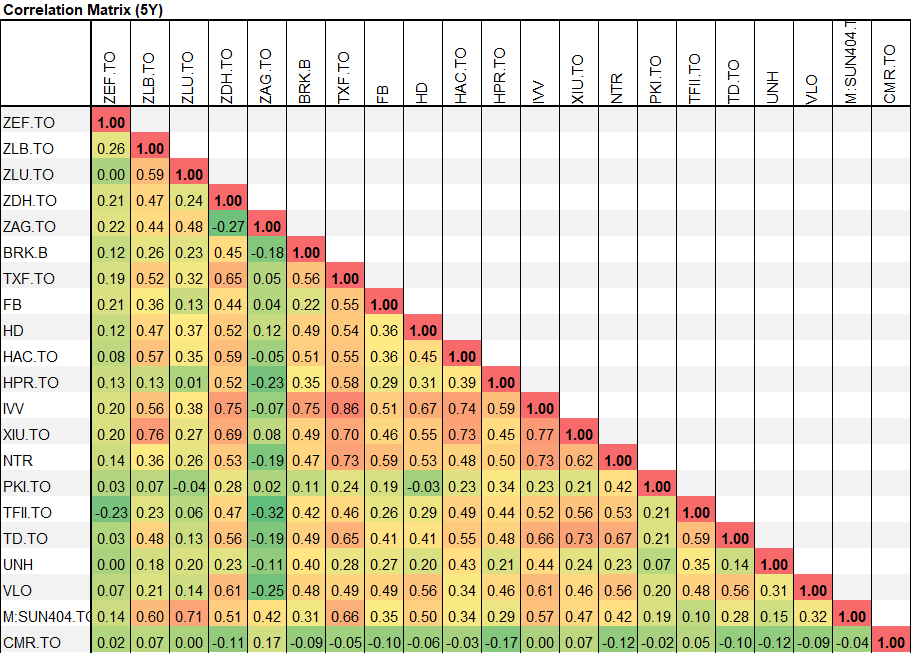

- Combine assets with low to negative correlations. This is a good one for all of you stats geeks out there. Correlation, in our context, is a statistic that measures the degree to which two securities move in relation to each other.[1] In layman’s terms, how one zigs while the other zags. This relationship is expressed using a correlation coefficient, which is a number value between (-1.0 and +1.0). When the correlation between two securities reaches +1.00, it means that they behave almost exactly the same way. In other words, they tend to go up-and-down in the same fashion. When this number is low there is little relationship, and when it goes negative, then there is an inverse relationship. Below are the securities in one of our models put onto a matrix. I know it looks a little busy, but what it shows is the correlation coefficients between the different securities in the portfolio over a 5-year time period. Notice how little bright red there is. What that indicates is that there is a good level of diversity, or variation, in the securities of the portfolio because most of the assets are mildly or negatively correlated. In other words, not all the securities are moving in the same direction when the market sells off or advances. For example, look how ZAG.TO (Canadian bonds) is either very lowly correlated or negatively correlated to most others. This is a good thing for us!

[1] https://www.investopedia.com/terms/c/correlation.asp

- As the title suggests the only free lunch on Wall Street, or Bay Street for that matter, is diversification. The above examples show a couple of ways this can be accomplished in a portfolio to manage risk. There are other ways in which we do this as well which are good to remember. Investors should also diversify by sector, industry, geography, and position size. While nothing is perfect these tools help us manage risks and shocks over the short-run, while also keeping us invested for the long-run

Regards,

Patrick

Information in this article is from sources believed to be reliable, however, we cannot represent that it is accurate or complete. It is provided as a general source of information and should not be considered personal investment advice or solicitation to buy or sell securities. The views are those of the author, [name], and not necessarily those of Raymond James Ltd. Investors considering any investment should consult with their Investment Advisor to ensure that it is suitable for the investor’s circumstances and risk tolerance before making any investment decision. This article provides links to other Internet sites for the convenience of users. Raymond James Ltd. is not responsible for the availability or content of these external sites, nor does Raymond James Ltd endorse, warrant or guarantee the products, services or information described or offered at these other Internet sites. Users cannot assume that the external sites will abide by the same Privacy Policy which Raymond James Ltd adheres to.

Raymond James Ltd. is a Member - Canadian Investor Protection Fund.