US Biotech - an opportunity in a Pandemic

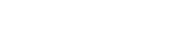

For this month’s comments, I wanted to turn your attention to an actionable investment idea: US biotechnology companies. If we’re going to talk about COVID-19 anyway, let’s find a silver lining in the discussion. Pictured below are performance numbers of companies actively engaged in the development and distribution of a vaccine for COVID-19. The top three companies are Moderna (purple), Regeneron (orange), and Gilead (blue). The final two lines act as a reference points and include the Nasdaq biotech sector ETF (green) and the S&P 500 (pink).

Here are my thoughts:

- US biotech companies have outperformed the S&P 500 on a relative and absolute basis.

- Initial speculation for a vaccine has rocketed Modera’s (MRNA) share price. Moderna’s mRNA vaccine is currently being used in a NIH-funded trial in Washington state.[1]

- Regeneron is involved in a clinical trial with an anti-arthritic drug Kevzara to treat COVID-19.[1]

- Gilead’s remdesivir is also being used in clinical trials to alleviate symptoms of COVID-19.[2]

- No one knows which biotech company will come out on top, so an investment in IBB (iShares Nasdaq Biotechnology ETF) will provide a broad-based option to the overall industry and the possible engineer of the vaccine.

- While the performance of IBB is notably negative, it has outperformed the S&P 500, and it provides us with a reasonable entry point into the space. We will discuss the idea in further detail below.

[3] https://www.gilead.com/purpose/advancing-global-health/covid-19/remdesivir-clinical-trials

IBB (iShares Nasdaq Biotechnology ETF)

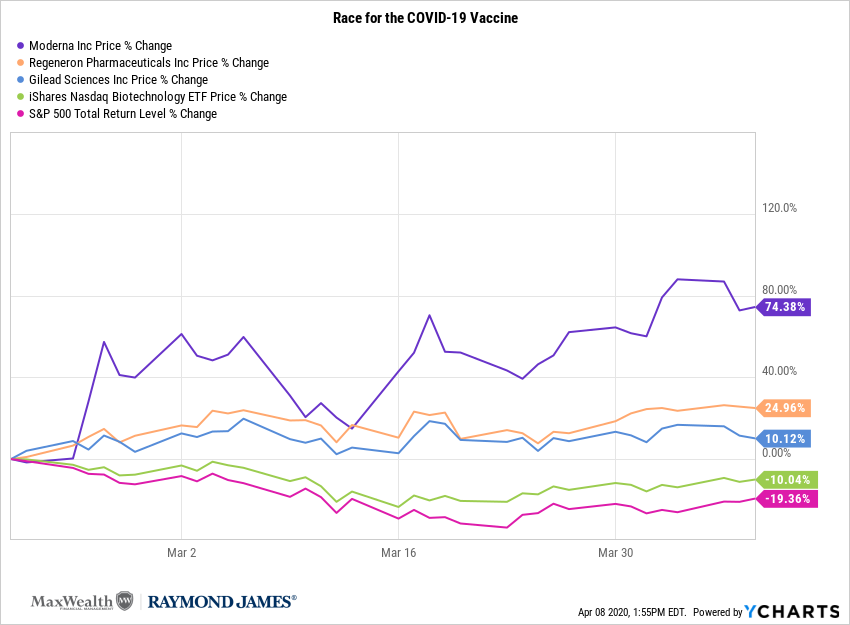

Firstly, we gain exposure to the three front-runners in the COVID-19 vaccine race. As you can see below, they are listed in the top 25 holdings.

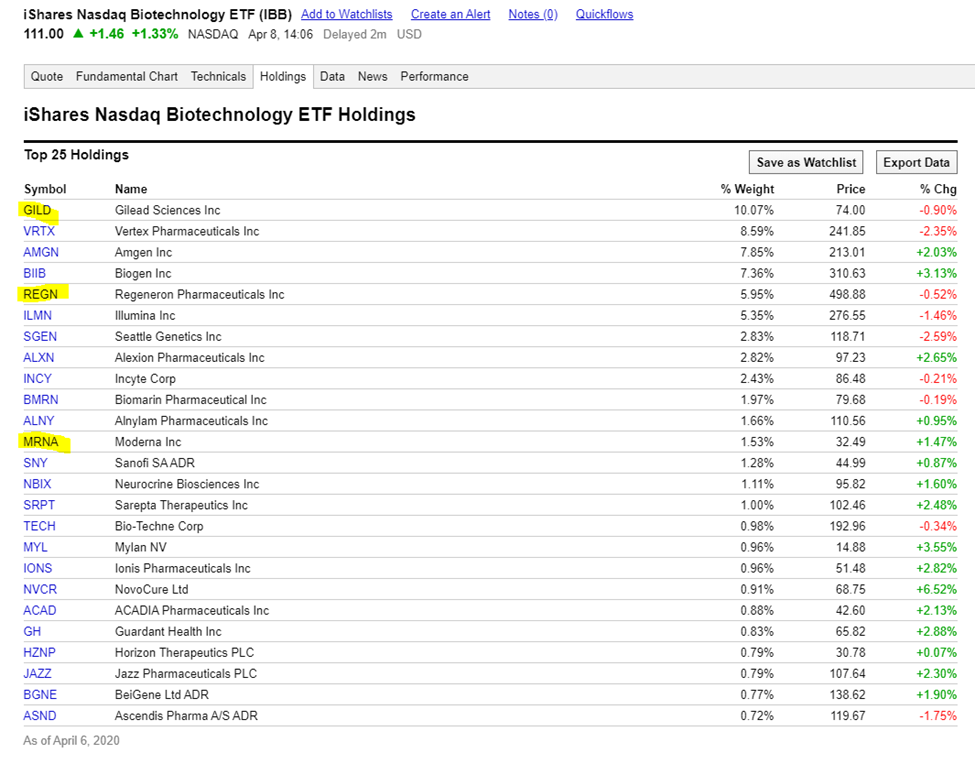

The technical picture of IBB is quite compelling: relative strength, momentum, and price performance are improving. We would be further convinced if volume also confimed price movement to the upside. I suspect this will surface shortly given the “green-lights” below.

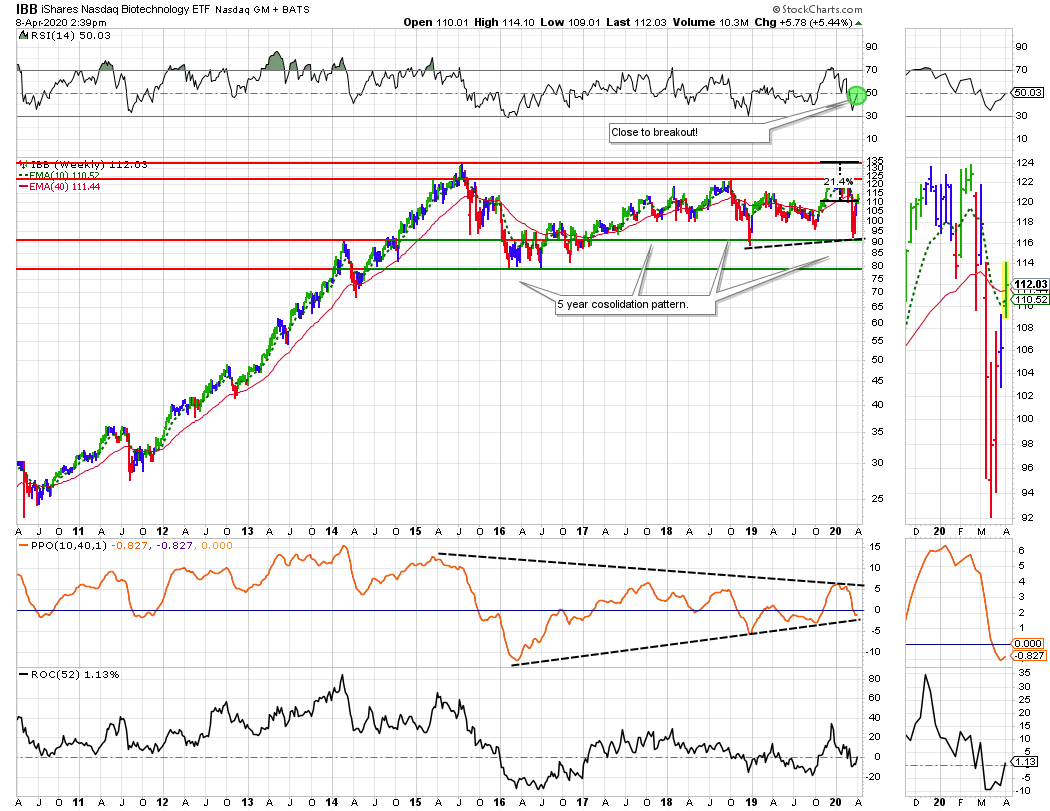

As we turn our attention to a longer-term (10 year weekly chart), we can see further evidence of green shoots. 52 week rate-of-change has turned positive, the 14 week relative strength indicator is now above 50, and price looks to be breaking out from a five year consolidation pattern. While this is not definitive, it does add to the weight of the evidence.

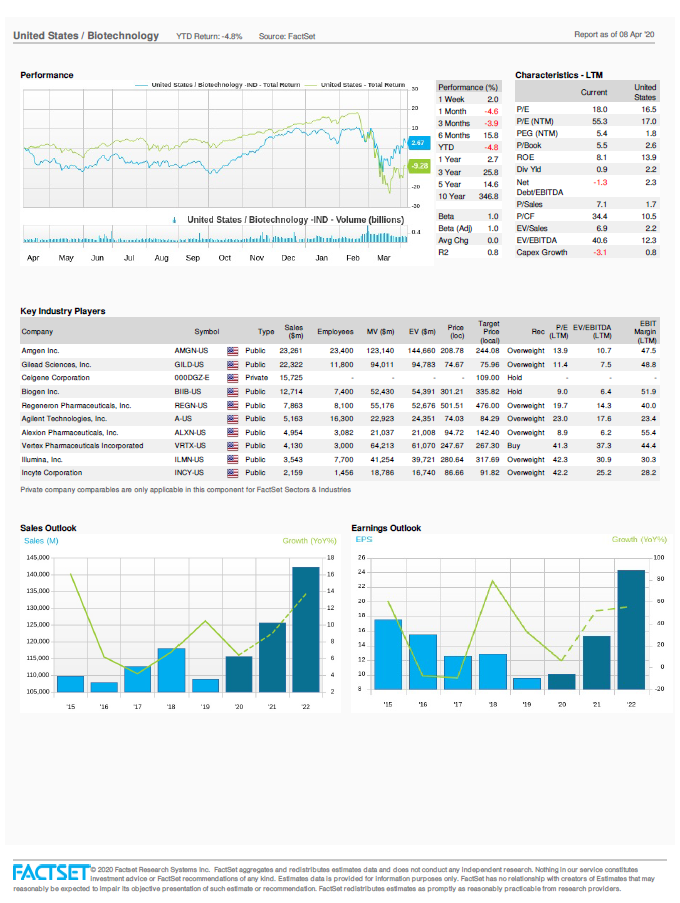

We would be remiss if we did not include some fundamental data in our analysis. Here is a summary of the US biotechnology industry and my thoughts:

- On a trailing 12-month basis this industry is hardly cheap relative to the market. The characteristics box clearly indicates that we have paid substantially for this industry’s growth and innovation.

- Sales and earnings are projected to decline in 2020, but are set to rebound in 2021, 2022.

- Most broker recommendations are either buy or overweight, so there should be some institutional support behind the names in IBB.

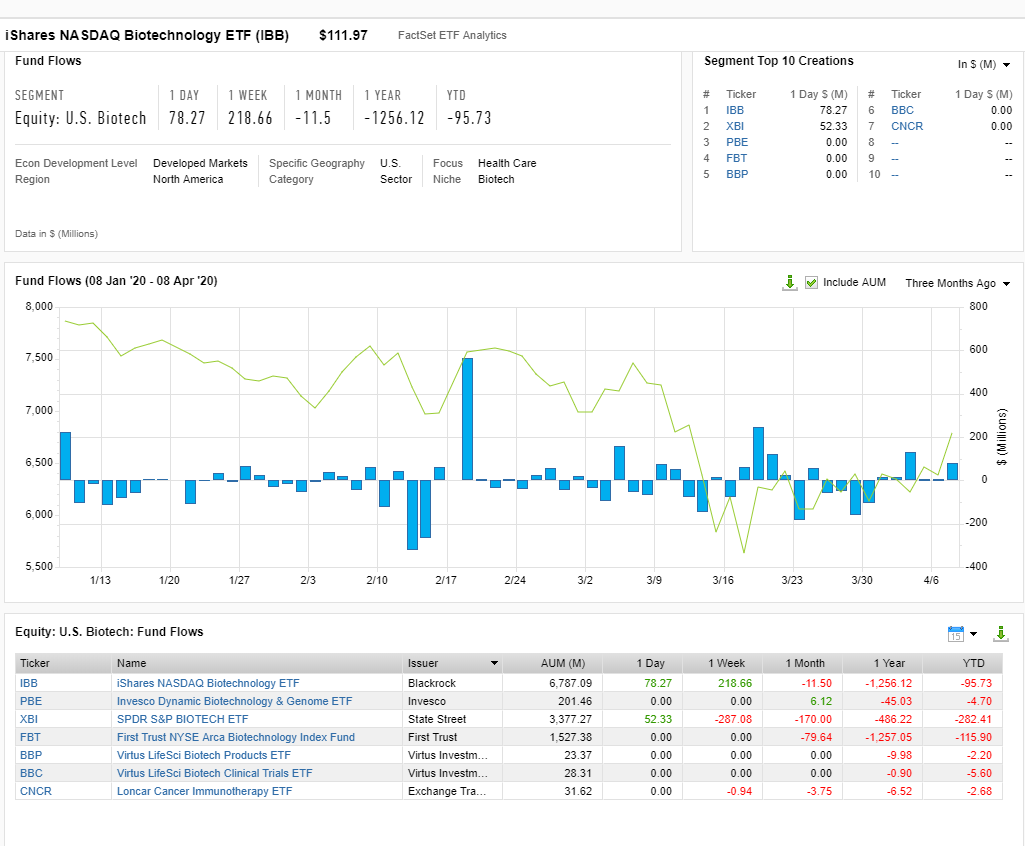

A final point for review is the fund flows report pictured below. In the last three months, new unit creation is finally positive as depicted in the AUM green line. Given the race for a vaccine and therapeutics to treat COVID-19, we would not be surprised to see further fund flows into this industry. An increase in activity here would cofirm the volume needed for a substantial break-out in IBBs price.

A word of caution is always warranted. Biotechs are high-octane stocks that can move swiftly in one direction and another. Here are Raymond James Ltd., we classify them as high-risk securities. With that being stated, the IBB may be suitable for some investors with higher risk tolerances and longer time frames. Keep in mind that IBB is listed on US exchanges, and thereby, must be purchase with US dollars.

Regards,

Patrick

The enclosed article expresses the opinions of writer, Patrick A. Choquette, and not necessarily those of Raymond James Ltd. (“RJL”). Statistics, factual data and other information are from sources believed to be reliable but accuracy cannot be guaranteed. It is furnished on the basis and understanding that Raymond James Ltd. is to be under no liability whatsoever in respect thereof. It is for information purposes only and is not to be construed as an offer or solicitation for the sale or purchase of securities.

Information provided in the attached report is general in nature and should NOT be construed as providing legal, accounting and/or tax advice. Should you have any specific questions and/or issues in these areas, please consult your legal, tax and/or accounting advisor.This provides links to other Internet sites for the convenience of users. Raymond James Ltd. is not responsible for the availability or content of these external sites, nor does Raymond James Ltd endorse, warrant or guarantee the products, services or information described or offered at these other Internet sites. Users cannot assume that the external sites will abide by the same Privacy Policy which Raymond James Ltd adheres to.

>Information in this article is from sources believed to be reliable, however, we cannot represent that it is accurate or complete. It is provided as a general source of information and should not be considered personal investment advice or solicitation to buy or sell securities. The views are those of the author, Patrick Choquette, and not necessarily those of Raymond James Ltd. Investors considering any investment should consult with their Investment Advisor to ensure that it is suitable for the investor’s circumstances and risk tolerance before making any investment decision.

Raymond James Ltd. is a Member - Canadian Investor Protection Fund.