Seasonality Revisited

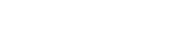

It has been a while since I’ve commented on the seasonal tendency for the stock market to advance in the last three months of the year. A few words of caution before we start our analysis: this is only a statistical trend and not a law without fail. Using research from our friends at Bespoke Investment Group, it is clear that a strong seasonal pattern exists for the S&P 500 in the fourth quarter. Over the past 10 years, the broad US market has been positive 94% of the time with a median return of 5.45% until the close of the year. What’s interesting is where the strength is on a sector and industry level.

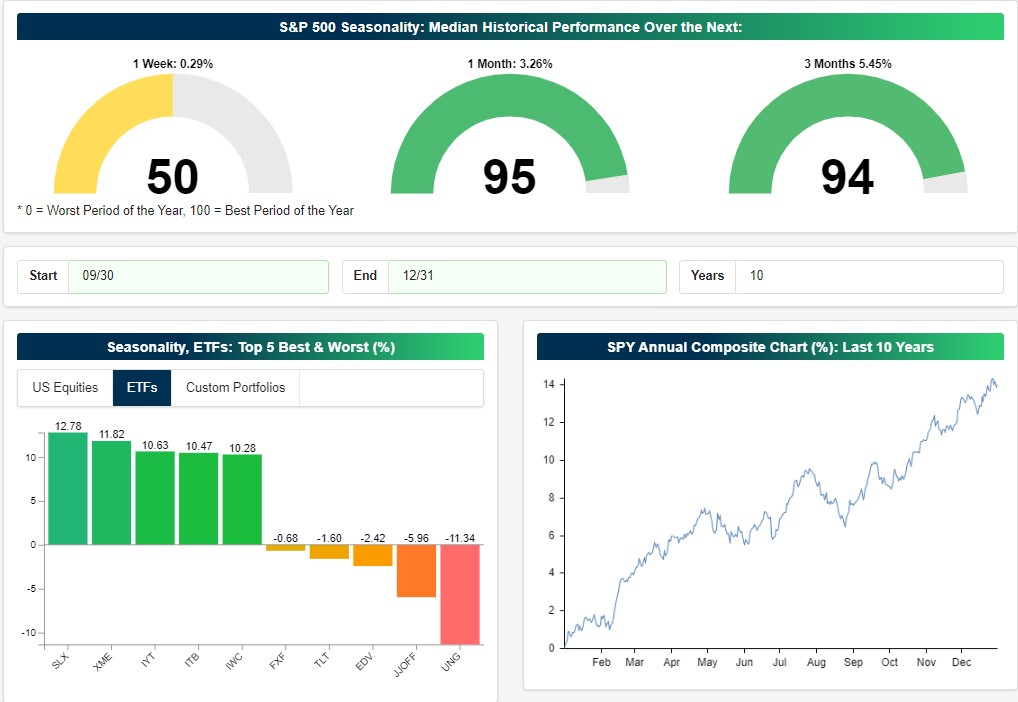

The next chart shows the Q4 2019 performance for the top five names based on median performance over the past 10 years. Clearly, metals and mining stocks are the ones to watch as we move into the last quarter of the year.

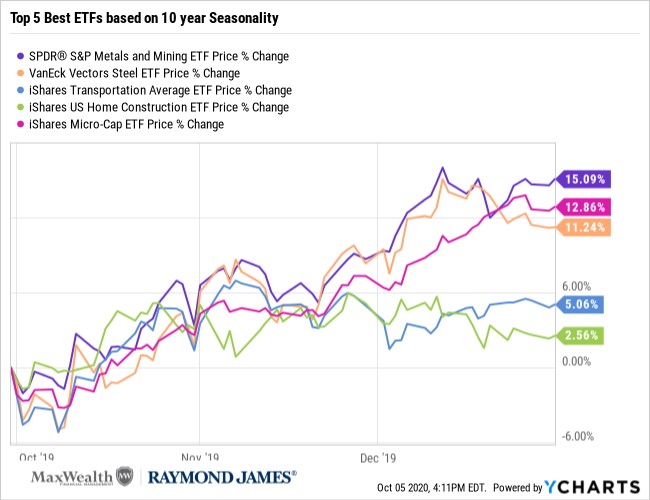

The specifics become clear as we drill down further into the top 10 positions of SPDR S&P metals and mining ETF (XME). These are all steel stocks or related industries.

Source: FactSet

Keep in mind this is not an endorsement to purchase any of the names presented above. It is the first step in investigating where the seasonal strength should come from if we are looking to add selectively to our portfolios. A further point to remember, XME has been positive 70% of the time in the past 10 years, but this came with three negative calendar years in 2018, 2015, and 2014.

As always, these investments may not be suitable for you at this time or based on your risk appetite. Please contact me, however, if you wish to continue the dialogue.

The enclosed article expresses the opinions of writer, Patrick A. Choquette, and not necessarily those of Raymond James Ltd. (“RJL”). Statistics, factual data and other information are from sources believed to be reliable but accuracy cannot be guaranteed. It is furnished on the basis and understanding that Raymond James Ltd. is to be under no liability whatsoever in respect thereof. It is for information purposes only and is not to be construed as an offer or solicitation for the sale or purchase of securities.

Information provided in the attached report is general in nature and should NOT be construed as providing legal, accounting and/or tax advice. Should you have any specific questions and/or issues in these areas, please consult your legal, tax and/or accounting advisor.This provides links to other Internet sites for the convenience of users. Raymond James Ltd. is not responsible for the availability or content of these external sites, nor does Raymond James Ltd endorse, warrant or guarantee the products, services or information described or offered at these other Internet sites. Users cannot assume that the external sites will abide by the same Privacy Policy which Raymond James Ltd adheres to.

Information in this article is from sources believed to be reliable, however, we cannot represent that it is accurate or complete. It is provided as a general source of information and should not be considered personal investment advice or solicitation to buy or sell securities. The views are those of the author, Patrick Choquette, and not necessarily those of Raymond James Ltd. Investors considering any investment should consult with their Investment Advisor to ensure that it is suitable for the investor’s circumstances and risk tolerance before making any investment decision.

Raymond James Ltd. is a Member - Canadian Investor Protection Fund.