Cybersecurity

“Cybersecurity is the protection of internet-connected systems such as hardware, software and data from cyber-threats. The practice is used by individuals and enterprises to protect against unauthorized access to data centers and other computerized systems.” techtarget.com

A week does not pass where I am not under threat from a cyber-criminal. The convenience of technology in a COVID world has been exploited by some dubious characters bent on doing financial damage to the unsuspecting. Of course, this means that we all should be on high alert and very protective of our personal information. It also means, we should be constructive on the growing need for cybersecurity solutions and how we may profit on their expansion.

We could simply browse for companies that provide this service, or arguably, we could investigate an ETF (exchange traded fund) which holds a basket of underlying cybersecurity companies. We prefer the later approach. Our research efforts have uncovered an investment called CIBR (First Trust NASDAQ Cybersecurity ETF) which looks to provide the answer. CIBR trades in USD, on the NASDAQ, and has over $2.0 billion in assets under management. It also has ample tradability through high daily share volume and low bid/ask spreads. In other words, acquiring shares is not a difficult task. One caveat with CIBR is that it branches out from a pure cybersecurity play into more diversified industries such as aerospace and defense. The alternative option HACK (PureFunds ISE Cyber Security ETF) is a better fit for cybersecurity, but it increases exposure to smaller, more illiquid names in the sector. There is also a potential manager change for HACK in late October, so we would hold off purchasing shares.

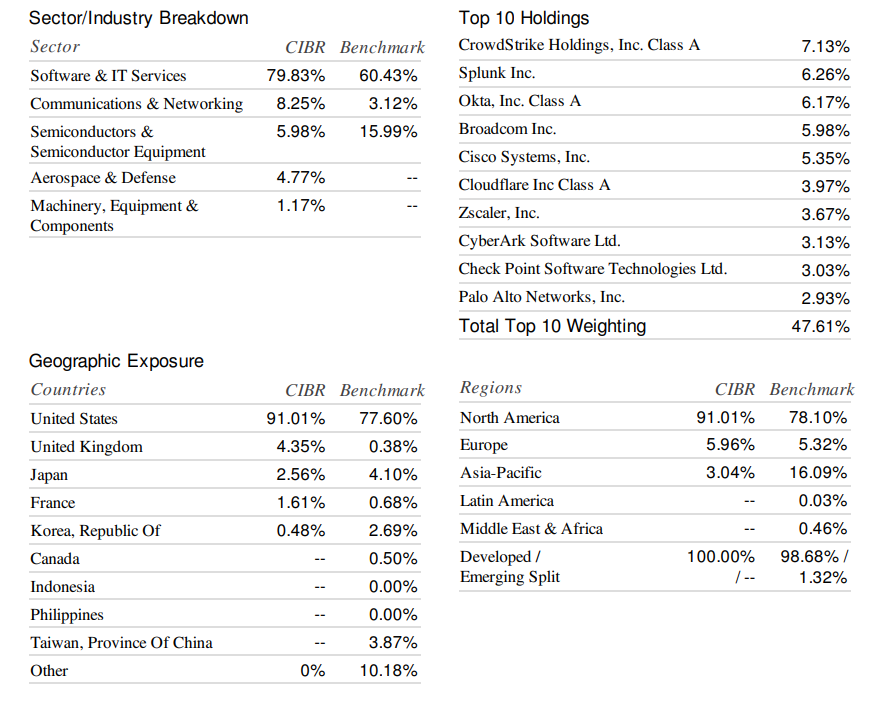

Pictured below is an under-the-hood look at the CIBR portfolio. Here are some of the more important highlights:

- 80% exposure to the software and IT sector.

- 90%+ exposure to the United States.

- Top 10 holdings comprise 47% of the portfolio weight.

- Mid-cap exposure of 39%.

Keep in mind that this security looks quite a bit different from the IYW (iShares US technology ETF) which most people use to represent the US technology sector. There are no FAANG stocks in CIBR. What it does offer, however, is further diversity in the technology sector with a concentration in cybersecurity-type companies. If you see a case for this industry, like we do, then this could be fertile ground for investment.

First Trust NASDAQ Cybersecurity ETF (CIBR)

Source: Factset

As always, this investment may not be suitable for you at this time, or based on your risk appetite. Please contact me, however, if you wish to continue the dialogue.

The enclosed article expresses the opinions of writer, Patrick A. Choquette, and not necessarily those of Raymond James Ltd. (“RJL”). Statistics, factual data and other information are from sources believed to be reliable but accuracy cannot be guaranteed. It is furnished on the basis and understanding that Raymond James Ltd. is to be under no liability whatsoever in respect thereof. It is for information purposes only and is not to be construed as an offer or solicitation for the sale or purchase of securities.

Information provided in the attached report is general in nature and should NOT be construed as providing legal, accounting and/or tax advice. Should you have any specific questions and/or issues in these areas, please consult your legal, tax and/or accounting advisor.This provides links to other Internet sites for the convenience of users. Raymond James Ltd. is not responsible for the availability or content of these external sites, nor does Raymond James Ltd endorse, warrant or guarantee the products, services or information described or offered at these other Internet sites. Users cannot assume that the external sites will abide by the same Privacy Policy which Raymond James Ltd adheres to.

Information in this article is from sources believed to be reliable, however, we cannot represent that it is accurate or complete. It is provided as a general source of information and should not be considered personal investment advice or solicitation to buy or sell securities. The views are those of the author, Patrick Choquette, and not necessarily those of Raymond James Ltd. Investors considering any investment should consult with their Investment Advisor to ensure that it is suitable for the investor’s circumstances and risk tolerance before making any investment decision.

Raymond James Ltd. is a Member - Canadian Investor Protection Fund.