US Small Caps Resiliency

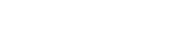

Before we begin the discussion, let’s first define our title. US small capitalized companies are generally represented by the Russell 2000 Index. This list of 2000 names have a median market cap of $1 billion USD, and constitutes roughly 10% of the entire US investible universe. So as the name implies, they are small companies. Pictured below are the top 10 names based on size in the index.

Heck, even GameStop (GME) made the list!

Source: YCharts

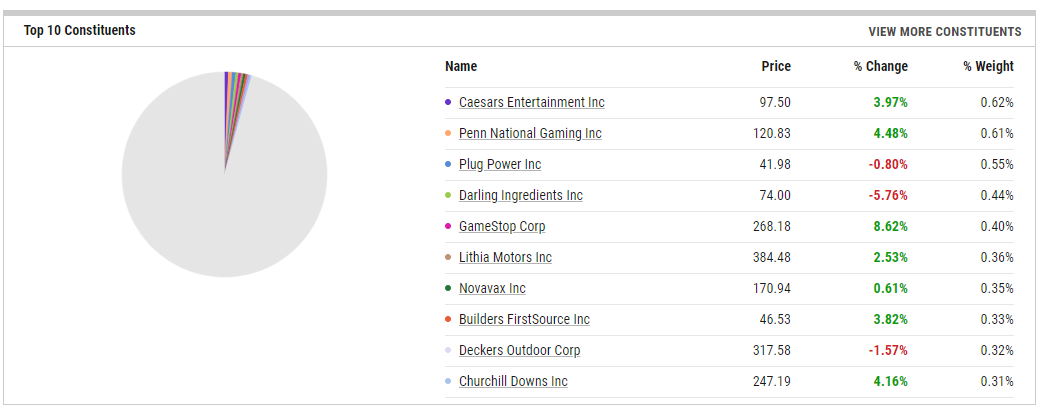

What’s interesting, in my opinion, about US small caps is their resiliency after the COVID lows in late March of 2020. As you can see in the chart provided below, the drawdown may have been greater at the lows versus the US Large Cap index (Russell 1000), but this volatility started to mirror the large cap index in early November. The purple and orange lines illustrate the pathways of the Russell 2000 and 1000 off of their all-time highs. Notice how they flatten out.

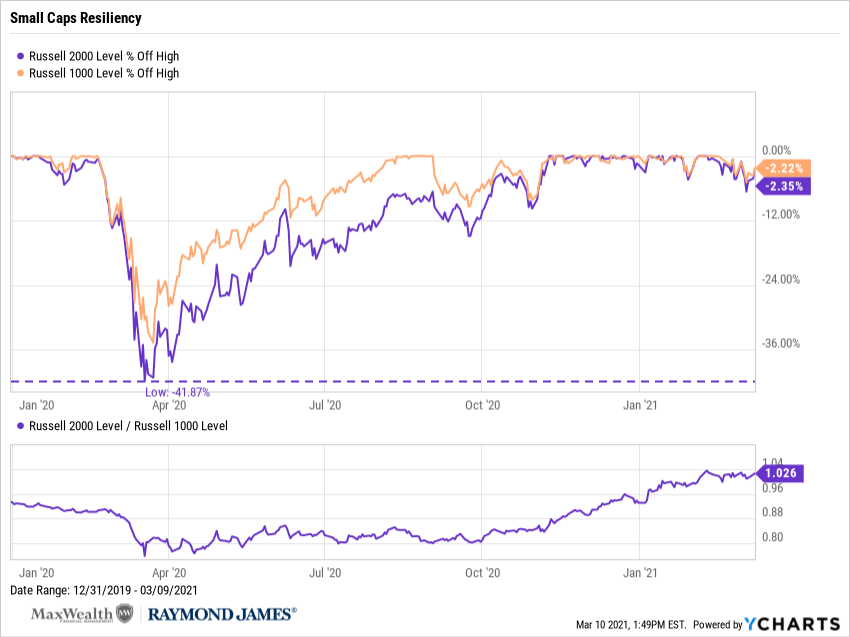

When we focus on this timeframe—the period after the US presidential election--we see a clear sign in new market leadership. Small caps outperform large caps by over 2-to-1.

Market strength in small caps is very productive for overall capital market health because it represents positive price discovery in the smallest producers of the economy. When the little folks are doing well, economic recovery and expansion are on a more stable footing.

Our take: Given the higher, historic volatility of small caps over large caps, be aware of the roller coaster price movements and use pull-backs to structural support levels to add exposure to a diversified portfolio. They have the ability to add octane to a portfolio’s return.

The enclosed article expresses the opinions of writer, Patrick A. Choquette, and not necessarily those of Raymond James Ltd. (“RJL”). Statistics, factual data and other information are from sources believed to be reliable but accuracy cannot be guaranteed. It is furnished on the basis and understanding that Raymond James Ltd. is to be under no liability whatsoever in respect thereof. It is for information purposes only and is not to be construed as an offer or solicitation for the sale or purchase of securities.

Information provided in the attached report is general in nature and should NOT be construed as providing legal, accounting and/or tax advice. Should you have any specific questions and/or issues in these areas, please consult your legal, tax and/or accounting advisor.

Information in this article is from sources believed to be reliable, however, we cannot represent that it is accurate or complete. It is provided as a general source of information and should not be considered personal investment advice or solicitation to buy or sell securities. The views are those of the author, Patrick Choquette, and not necessarily those of Raymond James Ltd. Investors considering any investment should consult with their Investment Advisor to ensure that it is suitable for the investor’s circumstances and risk tolerance before making any investment decision. Raymond James Ltd. is a Member - Canadian Investor Protection Fund.