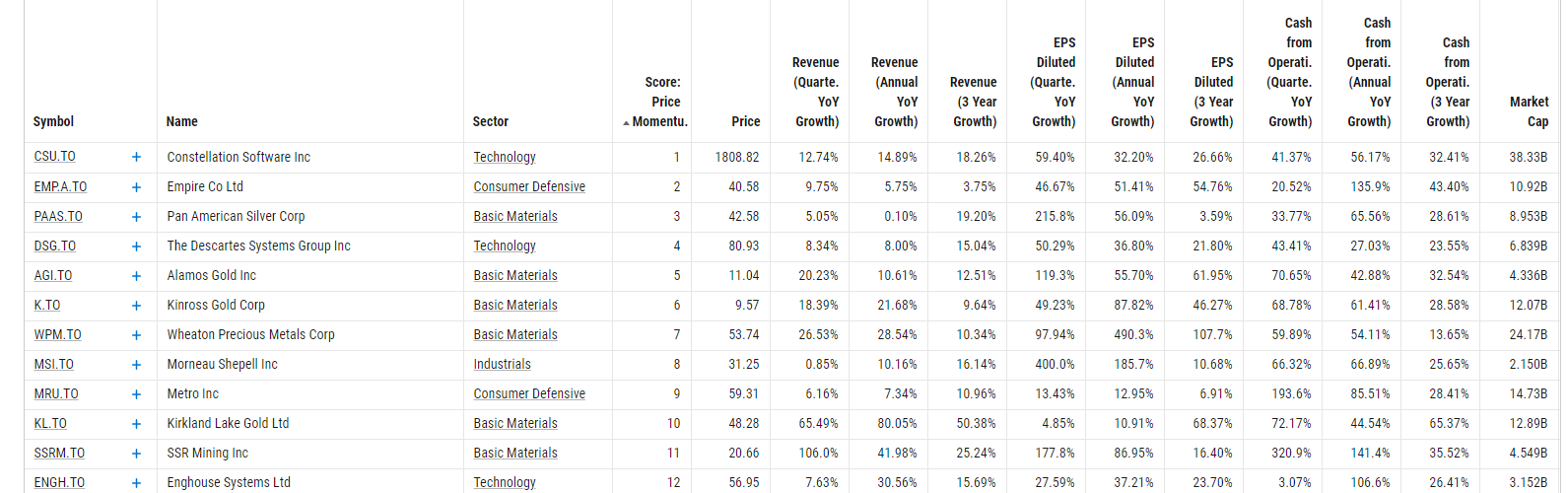

The Hunt for Growth in Canada

For a change of pace, we thought we would investigate some possible investment options that exist in Canada that rank high on the “growth” scale. In this context, we define growth as companies exhibiting growth in trailing revenue, EPS, and cash flow on both an annual and quarterly basis. For a company to make the cut, it must have greater than $2 billion CAD in market capitalization and show positive growth over the latest quarter, year, and three-year timeframe for each metric. Yes, this is a big hurdle, but we want a list of larger profitable companies in Canada. We apply a custom price momentum screen that ranks the list with the highest price performance first. Finally, we exclude the financial services sector because the metrics selected are not consistent with the key statistics to evaluate banks, insurers, and asset managers. Here is the output:

According to our screen, 12 companies pass the test out of a universe of 1,851 names on the TSE. Remember all growth numbers must be above 0 for the time-frames selected. What’s interesting here is the high participation rate of the basic materials sector. 6 out of the 12 names are in basic materials or 50% of the screen. So, what gives, and what reasonable conclusions can we draw from this dataset?

- Basic materials companies are cyclical in nature—highly sensitive to underlying economic conditions—so an improvement in global growth would eventually filter down to these companies. Clearly this is the case as the shorter timeframe percentages are showing explosive growth in these names.

- Technology is one of the preeminent growth areas for any economy, so inclusion of this sector makes sense because of the larger secular trend in technological innovation and utilization.

- Consumer defensive names such as Empire Co (EMP.A), and Metro (MRU) may seem anomalous at first, but remember the aggregate demand for groceries and sundries since the start of the COVID-19 pandemic. This demand would become drivers for revenues and earnings.

As always, any list of securities is really just a starting point for further investigation before an appropriate action plan can be implemented. What we find intriguing here is the evidence for the reflation trade idea. The general gist is that inflation is on the rise and commodity stocks tend to display positive correlation to the increasing threat of high, future prices. Clearly, miners are showing both earnings and price momentum growth, so a deeper dive into these companies is warranted. Sounds like a great topic for our next blog. Stay tuned!

The enclosed article expresses the opinions of writer, Patrick A. Choquette, and not necessarily those of Raymond James Ltd. (“RJL”). Statistics, factual data and other information are from sources believed to be reliable but accuracy cannot be guaranteed. It is furnished on the basis and understanding that Raymond James Ltd. is to be under no liability whatsoever in respect thereof. It is for information purposes only and is not to be construed as an offer or solicitation for the sale or purchase of securities.

Information provided in the attached report is general in nature and should NOT be construed as providing legal, accounting and/or tax advice. Should you have any specific questions and/or issues in these areas, please consult your legal, tax and/or accounting advisor.

Information in this article is from sources believed to be reliable, however, we cannot represent that it is accurate or complete. It is provided as a general source of information and should not be considered personal investment advice or solicitation to buy or sell securities. The views are those of the author, Patrick Choquette, and not necessarily those of Raymond James Ltd. Investors considering any investment should consult with their Investment Advisor to ensure that it is suitable for the investor’s circumstances and risk tolerance before making any investment decision. Raymond James Ltd. is a Member - Canadian Investor Protection Fund.