GameStop—The game stops here!

Given the numerous conversations about GameStop (GME-US), I thought it would be prudent to discuss what has transpired, and what lessons we may wish to take away from the aftermath. Let’s start with the setup. GameStop Corp is a multi-channel video game, consumer electronics, and wireless services retailer. You may be most familiar with the name EB Games here in Canada. Net income has been negative for the past 2 years, total debt has been climbing, and shareholder equity has been dwindling. Let’s face it, physical video game retail is not a good business model in a pandemic. Nor is it competitive in an environment where online streaming services are stealing market share. This usually creates an ideal situation for short-sellers to take a position in the security. They did. To review, a short sale is where shares are borrowed to be bought back later, and hopefully, at a lower price. The spread between the two prices is the profit--in the case of lower prices, or the loss—in the case of higher prices. What happened, in the specific case of GME, is that a “short-squeeze” occurred. Activist investors, spurned on through the social media site Reddit, decided to flood the market with buy orders for GME. Whenever you have more demand than the available supply--prices go up. This is even more pronounced when derivatives--like options trading—are involved.

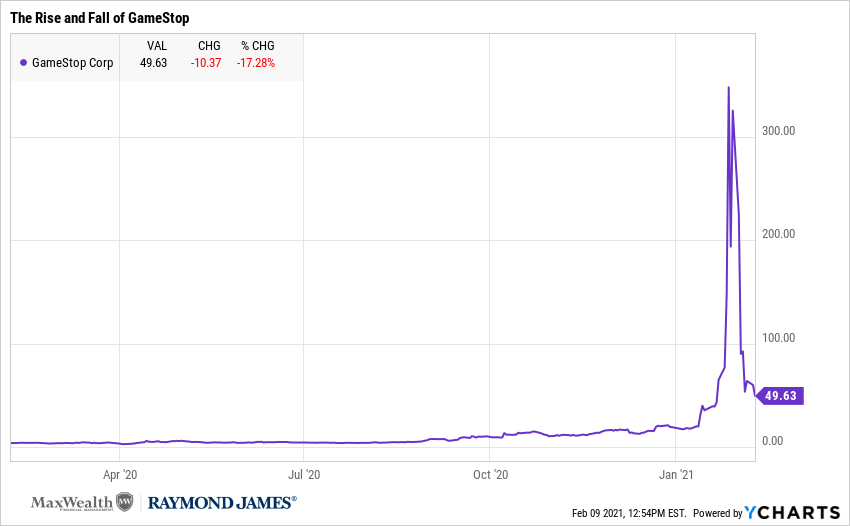

Here’s where it gets interesting. In this scenario, the short-sellers needed to buy back the shares at higher prices in order to close out their positions. So, what eventually happens is that we get a feedback loop which creates further buying pressure and even higher prices. The covering of these short positions caused massive losses for the hedge funds that held these funds short[1]. During the recent run-up, the price of GME hit a high of $347.51 USD on January 27th, 2021. At this price, that’s more than a 1700% return! The sentiment surrounding the squeeze was that the “little guy” banded together and really stuck it to the “Fat Cats of Wall Street”. What could go wrong? Well, as you can see in the price graph provided, GME has been sinking like a stone since February. Imagine if you got caught up in the hysteria of its price in the $300s. Where would you be now? Clearly, you would be deeply under water on the trade, and may need to meet a margin call, if you were using leverage to enhance your potential returns. We have seen this behavior before, back in 1999-2000, and that didn’t end well either. Our advice to everyone listening, including the hedge fund community, is know your risk.

We believe there are some observations worth noting on the unusual trading of GME:

- Social media can cause short-term price extremes. Whether it is Donald Trump’s outlandish tweets from the past 4 years, Elon Musk’s bizarre antics, or the thrust of activist investors on Reddit, information platforms can drive irrational market behavior in the moment. Of course, these ideas tend to fade and bring reality back to Earth. See the previous slide as a case in point.

- Commission-free trading. The rise of commission-free trading houses, such as Robinhood, have removed an important barrier to trading—cost. Retail investors are able to trade without a financial cost to the transaction. This is increasing order flow. In other words, the dynamic of buyers and sellers in the market. By the way, there is no such thing as a free lunch. Commission-free does not mean no cost. Free services often sell this “order flow” to the highest bidder meaning that you are not guaranteed the best execution for the trade. It is a known fact in professional circles, that the biggest costs in trading are related to bid/ask liquidity and not transaction fees.

- Casino Mentality. Here’s one more thing that we can blame on COVID. We have seen a perfect storm brewing in the US: government stimulus cheques, stay at home orders, closed casinos, and commission-free trading. Add this all up and you can see why retail investors have been using the stock market as a “one-armed bandit”! As with the casino analogy, however, this does not end well for the average bettor. We see this unfolding situation as one of the strongest cases for professional help and diligent wealth stewardship.

We hope that we have answered some of your questions regarding the extreme price and trading in GameStop since the beginning of 2021. Clearly, there are other imbedded topics that relate to this trade such as the ethics behind trading short or long, manipulations in the market, and the rise of democratic investing. Please reach out to us if you wish to plumb the depths of these topics or others.

The enclosed article expresses the opinions of writer, Patrick A. Choquette, and not necessarily those of Raymond James Ltd. (“RJL”). Statistics, factual data and other information are from sources believed to be reliable but accuracy cannot be guaranteed. It is furnished on the basis and understanding that Raymond James Ltd. is to be under no liability whatsoever in respect thereof. It is for information purposes only and is not to be construed as an offer or solicitation for the sale or purchase of securities.

Information provided in the attached report is general in nature and should NOT be construed as providing legal, accounting and/or tax advice. Should you have any specific questions and/or issues in these areas, please consult your legal, tax and/or accounting advisor.

Information in this article is from sources believed to be reliable, however, we cannot represent that it is accurate or complete. It is provided as a general source of information and should not be considered personal investment advice or solicitation to buy or sell securities. The views are those of the author, Patrick Choquette, and not necessarily those of Raymond James Ltd. Investors considering any investment should consult with their Investment Advisor to ensure that it is suitable for the investor’s circumstances and risk tolerance before making any investment decision. Raymond James Ltd. is a Member - Canadian Investor Protection Fund.

[1] https://fortune.com/2021/01/29/gamestop-stock-how-much-hedge-funds-have-lost-sellers-losses-gme-steve-cohen-point72-andrew-left-citron-research-short-squeeze/